Think of a corporate minute book as your company's official diary. It’s the single, authoritative collection of your most critical records, telling the complete story of your business from its inception. In Canada, this isn't just good practice—it's a mandatory legal requirement for every incorporated business. It serves as the definitive proof that your company is a legitimate, separate legal entity.

How would you prove you own your house without the deed? Or that you graduated from university without your diploma? The corporate minute book plays that same vital role for your business. It's the tangible evidence of your company’s existence, who owns it, and every major decision made along the way. This is no dusty binder meant for a shelf; it’s a living, breathing tool essential for keeping your company in good legal standing.

This official logbook holds everything from your company's birth certificate (the Articles of Incorporation) to its internal rulebook (the By-Laws). Just as importantly, it captures the ongoing narrative of your business through meeting minutes and resolutions, which are the formal records of every significant choice you make.

One of the biggest advantages of incorporating is creating a "corporate shield." This is the legal wall that separates your personal assets, like your home and savings, from your business's debts and liabilities. But that shield is only as strong as your paperwork.

If you neglect to maintain a proper minute book, you run the risk of something lawyers call "piercing the corporate veil." This is when a court decides your company isn't truly being run as a separate entity, but more like a personal piggy bank.

Key Takeaway: An outdated or non-existent minute book is an open invitation for creditors or litigants to argue that your personal assets should be fair game for covering business debts. Without this official diary, your corporate shield can easily crumble.

Keeping this record diligently shows everyone—from government agencies and banks to investors and the courts—that you are running your business with the care and professionalism it deserves.

While staying compliant is a huge motivator, a well-kept minute book offers real-world business advantages. It becomes your go-to source for essential information and is absolutely critical in several common scenarios:

Trying to recreate years of records at the last minute is a nightmare. It's not only incredibly stressful and costly, but it can also cause you to lose out on these kinds of major opportunities.

The good news is you don’t have to be a legal expert to get this right. Start Right Now simplifies the entire thing right from the start. When you incorporate with us, we provide a professionally organized, compliant digital minute book. This ensures your company’s story is told correctly from day one, building a strong foundation, keeping your corporate shield intact, and setting you up for future success.

A corporate minute book is much more than a binder stuffed with papers; it’s the official story of your company, told through a series of legally significant documents. Each piece plays a specific part, and understanding how they fit together takes the mystery out of maintaining this crucial record.

Think of it like building a house. You need a solid foundation and a detailed blueprint before you can even think about putting up the walls. For your corporation, these foundational documents prove your company exists, set the ground rules, and keep track of who owns it. This creates a legal structure that protects you and your business from future headaches.

Let’s break down the key documents and see how they contribute to a complete and compliant corporate minute book.

At the very heart of your minute book are the documents that officially create your corporation and define what it is. These are the absolute non-negotiables that banks, investors, and the Canada Revenue Agency will want to see.

Articles of Incorporation: This is your company’s birth certificate. It’s the government-stamped document proving your corporation is a legal entity, separate from its owners. It lays out the basics like your corporate name, director structure, and how your shares are set up. You can learn more about what is an Article of Incorporation in our detailed guide.

Corporate By-Laws: If the Articles are the birth certificate, think of the By-Laws as the internal rulebook. This document governs how your corporation operates day-to-day. It sets out procedures for director meetings, shareholder voting, the duties of officers, and other essential processes that keep things running smoothly.

These two documents are the bedrock of your corporation's legal framework. They are the first pieces of the puzzle that Start Right Now expertly prepares and organizes for you.

With the company legally formed, the minute book must clearly answer two vital questions: who’s in charge, and who owns the place? This is where your registers and ledgers come in, providing a clear, up-to-date record of control and ownership.

These aren't "set it and forget it" documents. They're living records that you must update every single time a change happens.

Why This Matters: During a dispute, an audit, or the sale of your business, these registers are the final word on who owns what. Any fuzziness here can kill deals and spark massive legal problems. A clean, professionally kept set of registers is essential.

Here’s a look at the key records that track this information:

Directors Register: This is an official list of every person who has served on the board of directors. It includes their names, addresses, and the dates they started and stopped being a director.

Officers Register: Just like the Directors Register, this one lists the corporation’s key officers—like the President, Secretary, and Treasurer—along with their terms of service.

Shareholders Register and Ledgers: This is the master list of all shareholders. It details who owns shares, exactly how many they own, what class of shares they hold, and when they got them.

Manually creating and updating these registers is a painstaking task, and a single mistake can have serious ripple effects. When you incorporate with Start Right Now, our platform automatically generates these critical records, ensuring they’re accurate and properly formatted right from the start.

To help clarify, here is a quick overview of the essential documents and their roles:

These documents work together to tell a complete story, giving you, your partners, and external parties a clear and legally sound picture of your corporation.

Once your foundation is set and ownership is clear, the final role of the minute book is to keep a running log of your business’s major decisions. This is done through resolutions and meeting minutes, which serve as the formal, written proof of every important corporate action.

These documents demonstrate that your company is being managed correctly and that all key decisions—from opening a bank account to taking on a major loan—were legally approved.

Resolutions: A resolution is a formal document that records a specific decision made by the directors or shareholders. For instance, a "Director's Resolution to Appoint Officers" is the legal act that officially names the company's executive team.

Meeting Minutes: These are the official notes from formal meetings of directors or shareholders. They summarize what was discussed, which motions were made, and how everyone voted, creating a permanent record of the proceedings.

Together, these documents build a clear and defensible history of your corporation's journey. Start Right Now makes this easy by providing templates and a simple process to generate the necessary organizational resolutions when you incorporate, ensuring your minute book tells a complete and compliant story from day one.

A corporate minute book isn't a trophy you create once and then leave on a shelf to gather dust. It’s better to think of it as your company's official diary—a living, breathing chronicle of its journey that needs to be kept up to date.

Keeping it current isn't just good practice; it's a fundamental discipline, much like balancing your financial books. This active record-keeping is what keeps your corporate shield strong and your business ready for whatever comes its way. Every major decision, every change in leadership, every financial milestone needs to be documented as it happens. Neglecting these updates is one of the easiest ways to create serious legal and financial headaches down the road.

Certain business activities should immediately trigger an update to your minute book. Failing to record these events can sometimes invalidate the actions themselves or, at the very least, create a confusing and inaccurate corporate history. Think of these as non-negotiable to-dos.

Here are the most common triggers that demand a new entry:

Each of these events requires a specific legal document, like a resolution or an updated register entry. Drafting these correctly can be surprisingly complex and time-consuming if you’re trying to do it all from scratch.

Even if you're a solo entrepreneur running a one-person corporation, Canadian law requires you to follow certain annual formalities. These aren't optional meetings you can just blow off. They are a core part of demonstrating that your company is a legitimate, separate legal entity.

A critical piece of this annual business hygiene is holding and documenting yearly meetings for both directors and shareholders. For small businesses, this is often done "on paper" through written resolutions, but the key is that it must be done.

These annual records typically confirm who the directors and officers are for the coming year and officially approve the company's financial statements. Skipping this step is one of the most common—and most dangerous—mistakes business owners make with their minute books.

The real-world consequences of a messy minute book often become painfully obvious during a tax audit or legal dispute. For example, the minute book is often the very first document a CRA agent will ask to see. If it's outdated, you'll be forced into a frantic, expensive scramble to recreate documents, which can cost thousands in legal fees and cause massive delays.

Manually tracking all these events, drafting the correct legal documents, and hitting every deadline is a huge weight for any business owner to carry. The work involved is often what keeps corporate paralegals busy; to get a sense of the detail required, it’s worth understanding what a corporate paralegal does.

This is exactly where a modern solution can make all the difference. Instead of wrestling with legal templates and worrying about compliance, Start Right Now gives you a simple, automated way to keep your minute book perpetually audit-ready.

When a significant event happens in your business, our platform guides you through generating the necessary resolutions and records in just a few clicks. We help turn ongoing compliance from a stressful chore into a simple act of good business hygiene, ensuring your corporate minute book is always accurate, complete, and ready for your next big move.

When you set up a business in Canada, one of the first big forks in the road is deciding whether to incorporate federally or provincially. Both routes create a distinct legal entity for your company, but they put you on different paths when it comes to the rules you have to follow—and that includes how you manage your corporate minute book.

At a high level, the purpose of a minute book is the same everywhere. Every jurisdiction, from the federal level down to each province, expects a corporation to keep a detailed log of its ownership, who's in charge, and the major decisions it makes.

But the devil is in the details. The specific laws, like the federal Canada Business Corporations Act (CBCA) or Ontario's Business Corporations Act (OBCA), each have their own quirks. These subtle differences are easy to miss but can create real headaches for entrepreneurs.

The differences between federal and provincial rules can seem small and technical, but they often have very practical consequences for how you run your business. It's not a matter of one being better than the other; it’s about knowing exactly which playbook your company needs to follow.

A classic example is the rule about where your corporate records have to be kept. Some provinces are very particular about your registered office address and insist that the minute book be physically located within their borders.

Practical Impact: This can really limit your flexibility. A federally incorporated business often has more freedom in choosing where to store its records. In contrast, if you're provincially incorporated in a place like Alberta or Ontario, you're locked into their local storage rules.

Trying to figure this all out on your own can be a maze. The decision to incorporate federally or provincially goes far beyond just your company name; it sets the entire compliance blueprint for the life of your business. We dive deeper into this choice in our guide to understanding federal vs provincial incorporation.

These jurisdictional distinctions are precisely why you can't take a one-size-fits-all approach to your corporate minute book. Grabbing a generic template off the internet is a huge gamble—you could easily miss a specific requirement for your province and unknowingly put your company out of compliance.

Here are just a few examples of how things can differ:

Trying to assemble the right documents and follow the correct procedures for your specific jurisdiction is tedious and fraught with risk. An error in your minute book isn't just a typo; it could weaken your liability shield and cause major problems when you're trying to secure a loan, facing an audit, or selling your business.

This is where Start Right Now gives you real peace of mind. We don't just file your incorporation papers. We make sure the corporate minute book you get is built from the ground up to match the legal requirements of your chosen jurisdiction. Whether you go federal or provincial, our platform automatically generates the right, compliant documents, taking all the guesswork out of the equation so you can get back to what matters—building your business.

Even the most diligent entrepreneurs can get tripped up by a few common minute book mistakes. And these aren't just minor clerical errors; they're the kind of blunders that can completely undo the legal protection you thought you had when you incorporated. Think of your minute book as the official story of your company—every mistake is like a missing or contradictory chapter.

Letting these details slide can lead to very real problems, like having a loan application rejected or, even worse, finding yourself personally on the hook in a lawsuit. Knowing what these traps are is the best way to avoid them. Let's walk through the most common and costly mistakes business owners make.

By far the most frequent slip-up is assuming that annual meetings and resolutions are just for big-name corporations with fancy boardrooms. That’s just not true. Every single Canadian corporation, even if it's just you, is legally required to hold and document annual meetings for both directors and shareholders.

Now, for most small businesses, this doesn’t mean renting a hall. It’s usually handled "on paper" with written resolutions that officially approve the year's financial statements and re-appoint the directors. When you skip this simple annual task, you're sending a message to the courts and the CRA that you’re not taking the "separate legal entity" part of your corporation seriously. That’s a dangerous signal to send.

Another huge misstep is making important business decisions on a handshake or a quick call and then forgetting to put it in writing. Your minute book needs to be the definitive record of every significant move your company makes.

Here are a few classic examples of decisions that absolutely must be documented:

Without this paper trail, any of these actions could be questioned or legally challenged later, creating a real mess.

The High Cost of Non-Compliance: When a company’s records are a shambles, a court can decide to "pierce the corporate veil," which means the shareholders can be held personally responsible for the company's debts. This isn't just a theoretical risk; failure to maintain proper corporate records is a key reason courts may decide to hold shareholders personally liable in legal disputes.

One of the quickest ways to demolish your corporate shield is to treat the business bank account like your personal piggy bank. Using company funds for personal expenses without the right documentation is a massive red flag for any auditor or judge.

If you need to pull money from the company, it has to be done correctly. It needs to be officially documented in a resolution as a proper salary, a declared dividend, or a formal loan from the company to you. When business and personal funds get tangled up without clear records, you’re basically daring a court to say there’s no real difference between you and your business.

These mistakes are entirely preventable, which underscores just how important it is to get your record-keeping right from the start. And it doesn't have to be a headache. Start Right Now's guided platform helps you build solid compliance habits from day one. We make it simple to create the resolutions and records you need, ensuring your minute book is always up-to-date and your corporate shield stays strong.

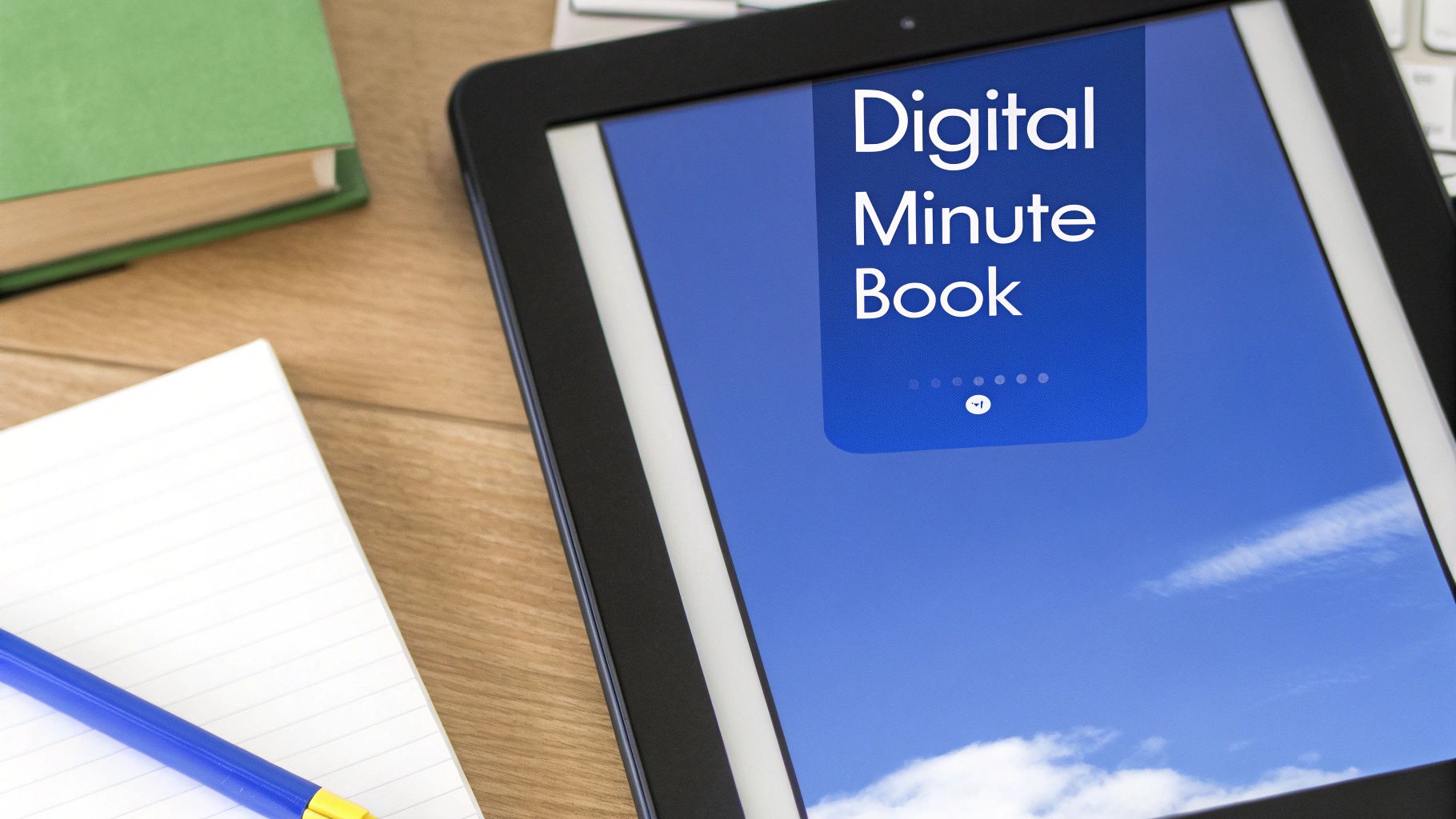

Let’s be honest, the days of that heavy, three-ring binder gathering dust on a shelf are numbered. For today's entrepreneurs, the traditional physical minute book is quickly being replaced by a far more efficient, secure, and accessible alternative: the digital minute book.

This isn’t just about swapping paper for pixels. It’s a fundamental upgrade in how you manage your corporation’s most critical records. Think about it: you need to confirm a shareholder’s details for your accountant, or maybe a lender is asking for your articles of incorporation. Instead of a frantic search for a physical binder, you can find, download, and securely share any document from anywhere, at any time. That’s a game-changer.

Beyond pure convenience, a digital minute book offers a level of security that paper just can't match. Physical documents are vulnerable to everything—fire, water damage, theft, or simply being misplaced. Losing your company's legal history would be catastrophic, and a secure, cloud-based system all but eliminates these risks.

This move to digital record-keeping is becoming the new standard for modern, compliant businesses. The trend is clear, as secure digital storage offers superior accessibility and protection, provided the records can be printed when needed.

Adopting a digital minute book is a smart move, especially when paired with strategies for mastering governance in the cloud to ensure your security and compliance are rock-solid. This approach doesn't just make your life easier; it positions your business as organized, forward-thinking, and ready for anything.

Key Takeaway: A digital minute book transforms a static, vulnerable binder into a dynamic, secure, and instantly accessible corporate asset. It protects your company's legal history while making key information available whenever and wherever you need it.

This is exactly why Start Right Now provides a secure and organized digital minute book with every incorporation we handle. We believe your business deserves a modern foundation from the moment it launches—one built for efficiency and resilience. Trust us, trying to digitize a messy paper trail years down the road is a headache you don't want.

Instead, we build your corporate minute book correctly in a digital format from day one. Our platform automatically generates all the essential documents, ensuring they are compliant and professionally organized. This seamless blend of technology and legal know-how is a core part of the modern online company registration process in Canada.

With Start Right Now, your critical records are always secure, always up-to-date, and always just a click away, giving you the confidence to manage your business effectively.

Getting a new corporation off the ground means you've suddenly got a lot on your plate. It's completely normal to have questions about the administrative side of things, so let's tackle some of the most common ones we hear about minute books.

You bet it is. This is a common point of confusion, but the legal requirement for a corporate minute book doesn't care about the size of your company. It applies to every single corporation in Canada.

Even if you’re the only director, officer, and shareholder, you still need to formally document your decisions. Think of it as wearing different hats. You need to record annual meetings (even if it’s just you signing the papers), approve your financials, and document any major business decisions. This is what keeps your personal liability separate from the corporation's.

Your minute book isn't a "set it and forget it" deal; it's a living history of your company. You should be updating it any time something significant happens.

This could mean bringing on a new director, issuing shares to an investor, taking out a business loan, or changing your corporate by-laws. At the very least, you have to update it once a year to document your annual resolutions for both shareholders and directors.

Losing your minute book or letting it fall out of date can cause some serious headaches. It’s not just a minor slip-up; it's a major compliance problem that can have real consequences.

An incomplete or missing minute book could put your limited liability protection at risk, making you personally responsible for corporate debts. It can also be a deal-breaker when trying to get a bank loan, and it will create huge legal and financial problems if you ever face a CRA audit or decide to sell your business. Trying to piece it all back together after the fact is a nightmare—and an expensive one at that.

The Solution: The best way to handle this is to stay on top of it from the start. A secure, digital minute book is a game-changer. It can't get lost in an office move, and it makes updates quick and painless, ensuring your records are always organized and ready when you need them.

Don't let corporate paperwork bog you down. When you incorporate with Start Right Now, we set you up with a professionally organized, compliant digital minute book right from the get-go. It’s the simplest way to build—and maintain—a solid legal foundation for your business. Get started with Start Right Now.